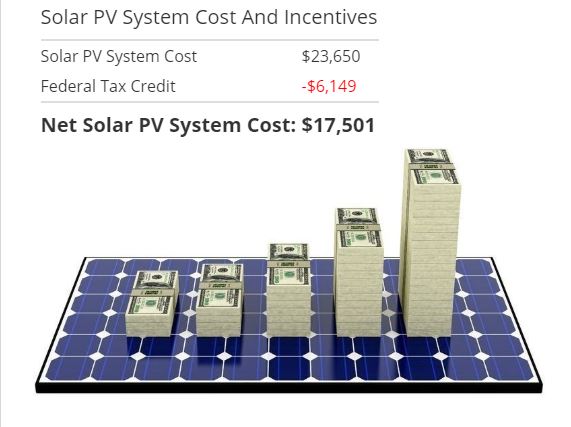

Solar Federal Tax Credit Example

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

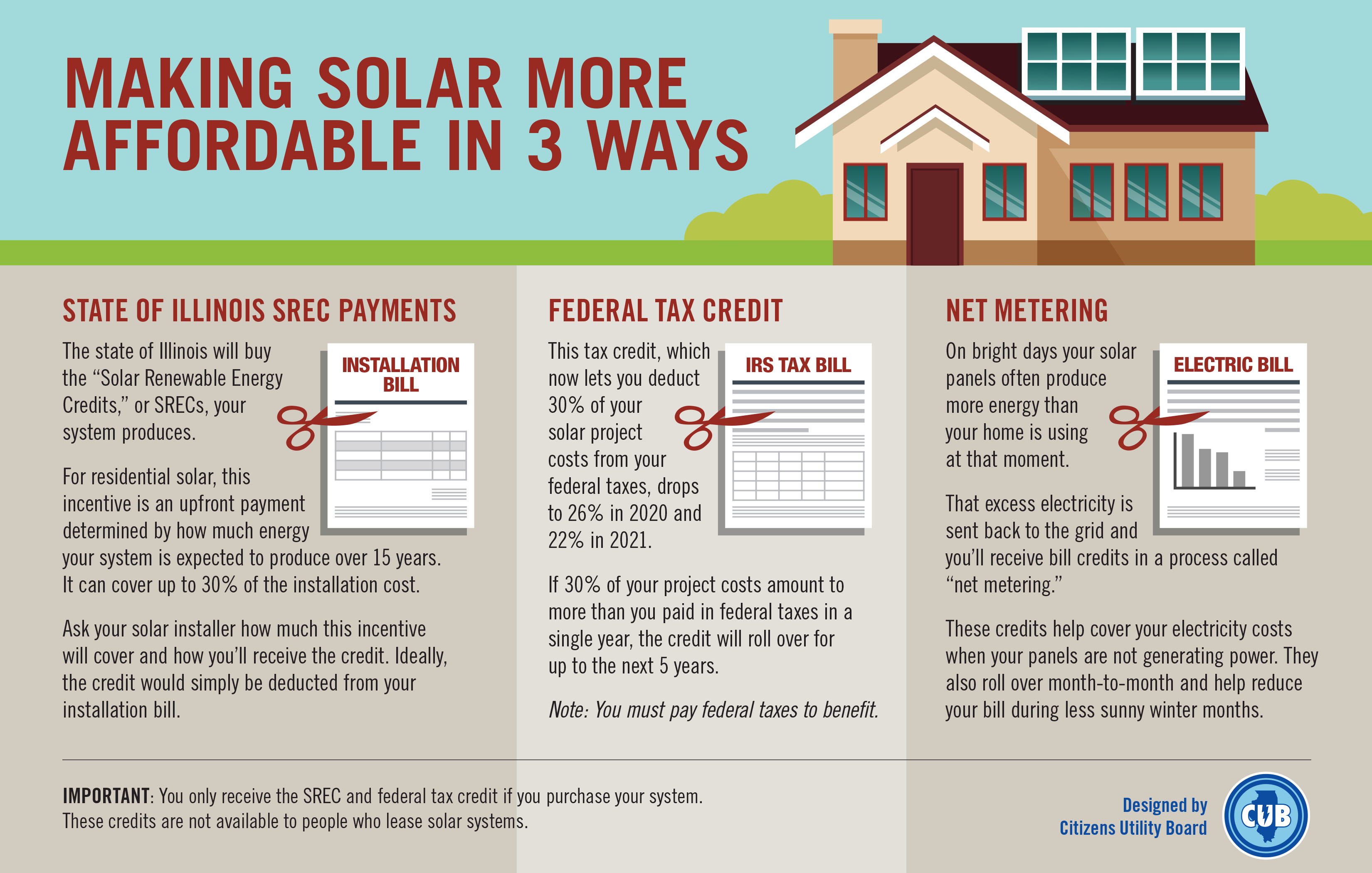

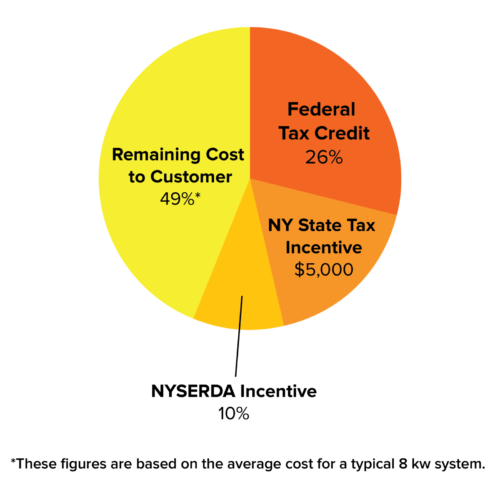

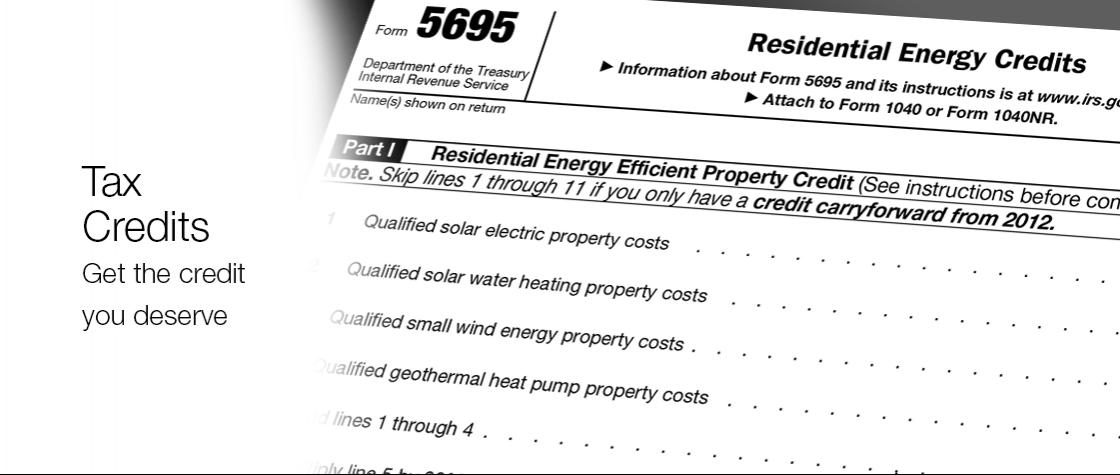

Solar federal tax credit example. What is the solar investment tax credit. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states. If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system. You calculate the credit on the form and then enter the result on your 1040.

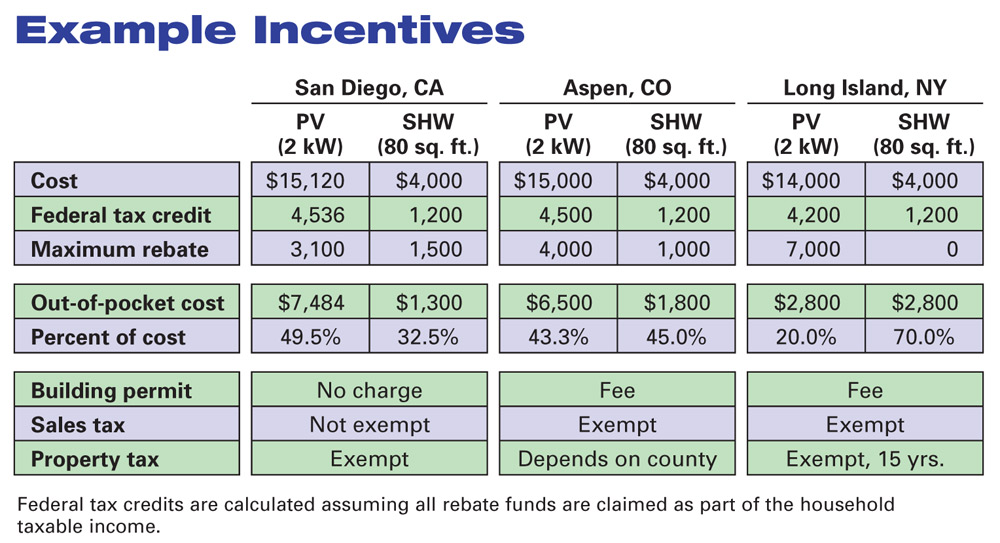

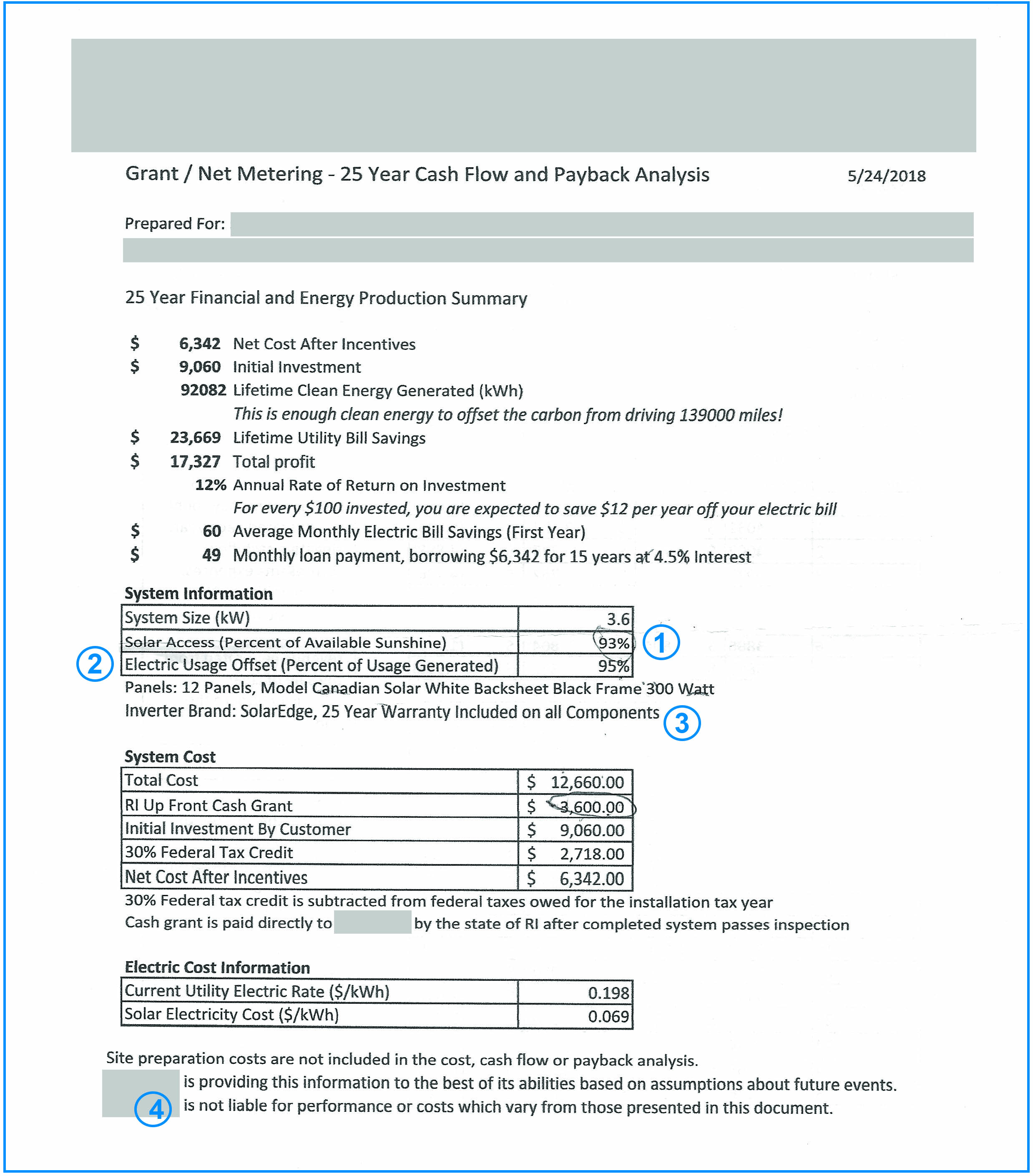

0 3 18 000 5 400 state tax credit. Federal solar tax credit steps down after 2019 it s hard to believe it s already 2019. Federal solar tax credit. For example an average sized residential installation of solar panels in california costs about 17 000.

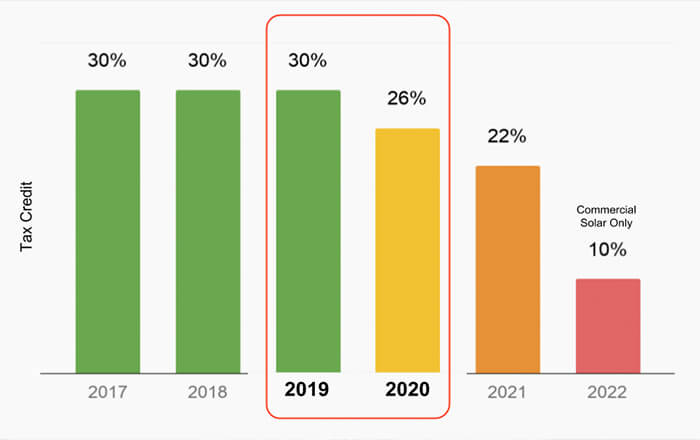

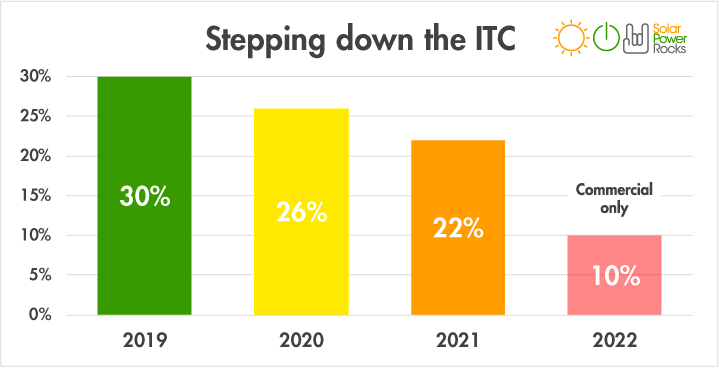

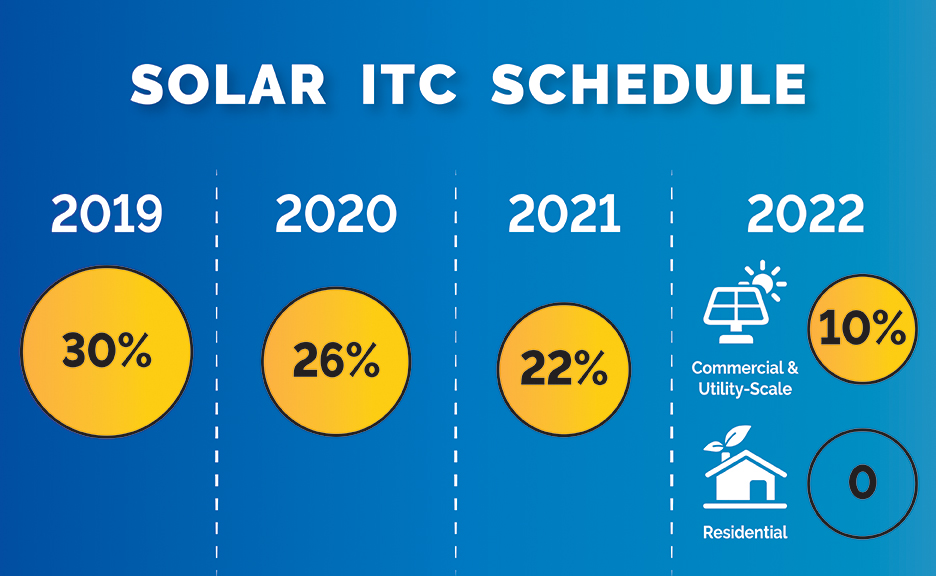

This year there s an important solar update every homeowner needs to be aware of. For example claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000. 30 of the costs of equipment permits and installation can be claimed back via your federal tax return. Line 5 add up lines 1 through 4.

To claim the credit you must file irs form 5695 as part of your tax return. Your federal tax credit. When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return. Enter 0 for lines 2 3 and 4.

The solar tax credit expires in 2022. The credit for that system would be 26 of 17 000 or 4 420. The federal solar investment investment tax credit itc is a tax credit that can be claimed on federal. The credit is applied to the following tax year so if you spend 10 000 on a new solar system you ll be able to take a.

For example if your solar pv system was installed before december 31 2019 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows. For example if a homeowner includes new insulation to the dwelling or adds led lighting to the interior and exterior to efficiently use the electricity generated by the solar system these items are not eligible for the federal investment tax credit. A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe. 5 minutes last updated on august 27 2020.

For this example we ll assume you only had solar installed on your home.

_540_449_80.jpg)

%20(2).jpg)