Solar Energy Ny State Tax Credit

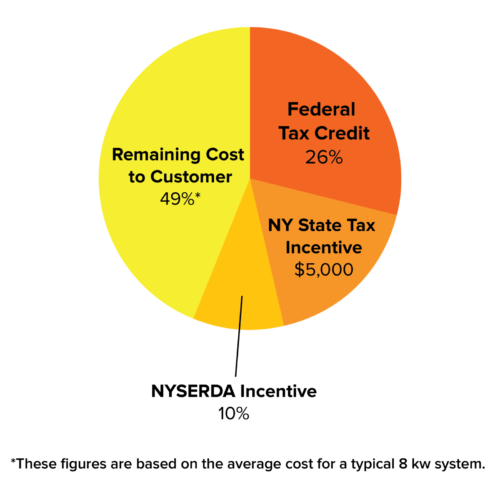

The owner of a qualified solar installation can file for federal tax credits and accelerated depreciation on the cost of the installation.

Solar energy ny state tax credit. In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home. Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. Detailed information on available incentives and loans for residential customers going solar. New york state offers several new york city income tax credits that can reduce the amount of new york city income tax you owe.

How much is the credit. Solar incentive and financing options. 7 if you don t pay enough in taxes to claim the credit in a year the excess credit will carry over to the following year. If you re a new york state business owner interested in filing for a tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

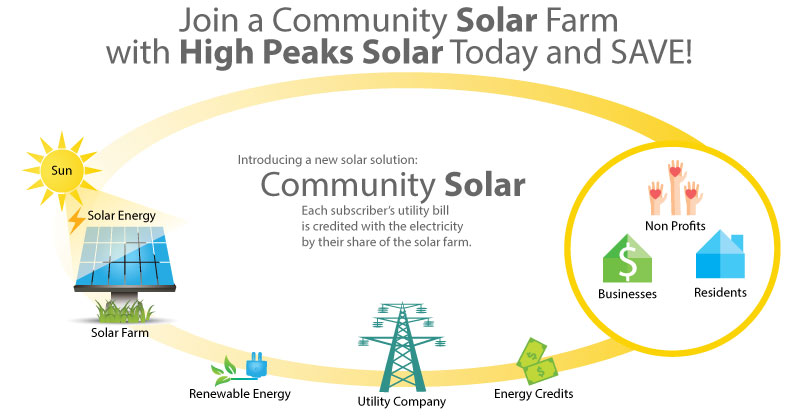

Arizona and massachusetts for instance currently give state income tax credits worth up to 1 000 toward solar installations. However any credit amount in excess of the tax due can be carried over for up to five years. New york state solar tax credit in addition to ny sun new york residents are eligible for a credit worth 25 of their system cost or up to 5 000 whichever is less. If your property isn t ideal for solar panels or you are not a homeowner community solar may be right for you.

In the case of a cooperative housing corporation or a condominium a percentage of the qualified solar energy system equipment expenditures may be attributed to each unit within the building. New york offers a state tax credit of up to 5 000. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

Solar energy system equipment credit. If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing. When pairing energy storage and solar you may be eligible for an energy storage incentive in addition to the current ny sun solar incentive. Real property tax credit.

In addition to incentive and financing options your business may qualify for federal and or new york state tax credits and rebates for getting solar. New york solar sales tax exemption. Guidance on determining federal and or new york state tax credit eligibility.

/Solarpanels-3156a12e053e49c88e4d7f53254fb8a8.jpg)